Our API mannequin has been listed with Oracle marketplace which can be used for creating, authorizing, capturing, voiding, refunding a fee as properly as getting data on earlier payments. Get in touch with our KYC consultants to find out how digitizing buyer and enterprise companion verification including face recognition the Video KYC advantages, can help your organization. The emergence of open banking has brought forth a wave of transformative alternatives for organizations, but at the identical time, it additionally presents complicated challenges for its adoption and implementation. Custom ranges of involvement, from launch help to 24×7 administration. It will be fascinating to see the brand new technological evolutions in open banking APIs and how banks embrace this alteration fix api. Banking Industry Architecture Network is a non-profit group that goals to promote and establish a normal architectural framework for enabling banking interoperability.

Monetary Info Supplier (fip) Api

In lots of areas, banks fail to offer the type of buyer expertise that fintech players can. Customers are ready to commerce private data in change for a customized experience. In truth, providing actual value in trade for buyer information can increase loyalty and trust.

How Are Apis Revolutionising Global Commerce Finance?

The objective of these rules is to increase market competitors, promote innovation, and improve consumer alternative in the monetary companies business whereas ensuring shopper information remains personal and safe. API marketplaces and ecosystems have turn into an essential part of the financial companies industry, offering a platform for firms to connect and exchange APIs. These marketplaces permit financial establishments to combine with different services, creating a community effect that may expand their offering and reach new prospects.

What Led To The Expansion Of Open Banking In Api

This is a “four-cornered” system – and has been used virtually since commerce started. Wrapped around this process is the problem of moving the cash – and trade has always involved a traditional standoff between the 2 events. The importer would a lot favor to pay later, ideally after goods are received and was money. This reduces his risk and means he can recycle his capital into new trades and new enterprise. Data sharing and Big Data have turn out to be the trending topics within the financial world of late.

Thanks For Subscribing To Aidoos! Stay Related For Updates!

This comfort has improved buyer satisfaction and encouraged customers to have interaction more incessantly with financial services. Open banking has enabled the creation of third-party financial management applications for budgeting, expense tracking, and personalised financial advice such as savings plans. These applications display a consolidated view of economic accounts across a number of banks and assist customers higher understand their funds.

Position Of Api On The Earth Of Worldwide Trade Finance

In other words, a group of pc software program and actions is known as API. The API, a code, permits data trade and interactions between two software programs. It allows for interactions between products or services without the necessity to understand how those connections work. These are organisations that already have giant numbers of shoppers – in reality, all exporters and importers are customers of banks and logistics firms. But bringing a model new product to market, especially a monetary product, would take many months and many millions of dollars. Upgrading a legacy environment to manage customers, payments, accounting, processing, operational risks, and knowledge is a hugely expensive and transformational task.

Digital Kyc: Empowering Open Banking With Compliance & Belief

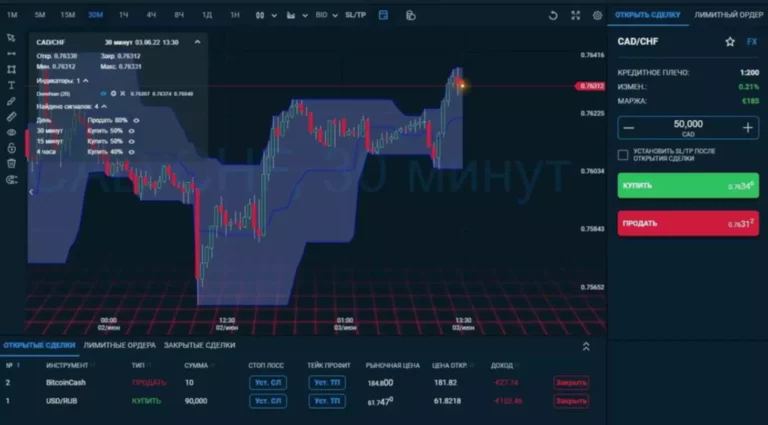

In the realm of finance, APIs (Application Programming Interfaces) check with a set of protocols, standards, and instruments that facilitate the trade of data between various systems and platforms. By providing a standardised method for different functions to work together with one another, APIs are instrumental in enhancing connectivity and integration throughout the financial sector. With API, traders can integrate their present platforms with 3rd celebration software program like charting functions and danger administration techniques. ‘FinX ‘ addresses the 360º digitization of banking and payments, especially addressing the final mile, without any further hardware/capital expenditure.

Advantages Of Api In Share Buying And Selling

The world’s most successful platforms and marketplaces, including Shopify and DoorDash, use Stripe Connect to embed payments into their merchandise. The API produced and revealed by PrimaDollar will be a private Partner API and entry for our purchasers will be absolutely managed by PrimaDollar. This entry is managed via Azure Active Directory using OAuth 2.0 and the uncovered Partner API is managed within the Azure API Management service. Fyers API is superb, we love the way it seamlessly connects with our platform and empowers our customers to automate trades. Their tech group is tremendous useful and on the toes to resolve your queries.

For instance, banking organizations can collect actionable data from inside and external sources relating to buying habits, financial goals and risk tolerance. This data can be utilized to allow more correct multichannel advertising and offer proactive solutions and advisory companies. For example, the Cashfree API banking platform permits you to send payouts in real-time to a number of accounts of different banks. It provides the function to verify UPI IDs for bulk payments and ship cash on to e-wallets or debit cards. These prospects count on a full vary of banking and financial services on these apps.

Teknospire permits the banks / financial institutions to build a digital ecosystem with Omni channels interface, along with all possible digital companies dispensation at the last mile. The services could be disbursed via B2C interfaces or via the assisted channels (digital contact points/agent network). These three elements combine to create the highway for a profitable open banking journey that revitalizes customer experiences, spurs innovation, and strengthens the organization’s position in the finance business. With open banking, insurance coverage corporations can customise their offerings by accessing customer monetary knowledge and analysing danger profiles, life levels, and monetary circumstances. Insurers use this data to offer personalised insurance policies and premiums that higher align prices and protection with particular person necessities. Open banking can help lenders evaluate credit by offering a detailed view of a customer’s financial history.

These bots can stream reside knowledge from multiple data feeds, and can route orders into a number of execution platforms. Our core focus has all the time been designing one hundred pc strong automated buying and selling software for shares, futures, options, commodities, ETF, forex and other assets. We have also included third get together knowledge feed API like Nanex, IQfeed, CGQ, eSignal, Kinectick, Barcharts and extra. Live news, quarterly stories api like Twitter, Bloomberg, Tradeconomis, Netdania, Reuters, and so on.

- You might please additionally note that every one disputes with respect to the distribution exercise would not have entry to Exchange investor redressal or Arbitration mechanism.

- Banks integrating their APIs can develop and construct their own branded monetary devices catering to particular customer wants.

- This enables establishments to tailor their services to meet their customers’ needs and optimise their efficiency.

- Technologies that use encryption to transmit knowledge, like SSL and TLS, protect sensitive data from unknown events.

- To use Yahoo Finance API Android Studio app there is a console offered for growth and establishing linkage between Android and Yahoo Finance API.

But instead of competing with the banks, utilizing APIs permits PrimaDollar to help the banks convey this new product to their customers directly and in their very own name, sharing revenues with the financial institution. Little information packets are made up only of the small print the trading API website is instructed to simply accept and are used for interaction between the website and clients. For instance, simply the commerce order and no further information from their system would move via the trading API. Another advantageous characteristic of a trading API is that the person experience could also be tailor-made to the traders’ requirements. Overall, APIs are set to be a driving pressure within the fintech business, which is able to lead to more personalised and environment friendly customer experiences, higher innovation, and new business opportunities. The finest trading APIs certainly differ in their varieties butare targeted at solving specific buying and selling issues.

Read more about https://www.xcritical.in/ here.